Entertainment

What Does She Owe Them?

Google News Recentlyheard

Though unique talks between Paramount World and Skydance Media are anticipated to finish and not using a deal, questions linger about controlling shareholder Shari Redstone’s obligation to minority traders, a few of whom have vocally opposed the merger on grounds that their pursuits have taken a backseat in negotiations.

A Paramount investor, in a grievance filed on April 30 in Delaware Chancery Courtroom, moved to pressure the corporate to show over data associated to talks with David Ellison’s Skydance. The Workers’ Retirement System of Rhode Island alleged that Redstone has “conflicting pursuits” undermining the corporate’s motives to discover a higher deal than the one supplied by Skydance.

The authorized transfer could possibly be a precursor to a lawsuit difficult any potential deal wherein widespread shareholders understand as enriching Redstone at their expense. It follows a number of legislation corporations, within the wake of Paramount’s deal talks with Skydance, asserting investigations into whether or not the settlement would hurt minority traders.

Paramount declined to remark.

Redstone’s management over Paramount’s destiny lies within the firm’s unorthodox possession construction. Nationwide Amusements, the household’s holding firm, owns her stake in Paramount with 77 p.c of preferential voting shares however roughly 5 p.c of widespread inventory. This provides Nationwide Amusements the facility to supervise Paramount’s operations whereas solely sustaining a ten p.c fairness stake.

The sale of Nationwide Amusements to Skydance would’ve turned on the completion of a merger between Paramount and the Ellison-led agency. And since she would’ve been paid for the sale of all the holding firm, it arrange completely different incentives for her and most shareholders.

This lawsuit focused Redstone’s alleged battle of curiosity. The pension fund requested for a court docket order to entry board supplies about the way in which wherein Ellison’s provide was evaluated, in addition to different gives for the corporate. Paramount denied entry to the recordsdata and as an alternative supplied to provide solely the “resolutions concerning the formation and mandate” of the particular committee shaped to evaluate the deal, in keeping with the grievance. It’s involved that the “Paramount Board has failed to stop Shari Redstone from diverting company alternatives or interfering with Paramount’s potential to hunt the perfect deal for Paramount and its different stockholders,” the lawsuit said.

Issues from minority shareholders are multi-pronged: The construction of the deal may’ve diluted present traders whereas forcing them to finance the funding in Skydance; the transaction may’ve undervalued Paramount; and the board was alleged to have failed to noticeably think about a reported $26 billion all-cash provide from Apollo World and Sony Footage.

To ease issues of a battle of curiosity and assess choices, an eight-person committee of unbiased board members was shaped. In a surprising flip, 4 Paramount administrators — Daybreak Ostroff, Nicole Seligman, Frederick Terrell and Rob Klieger — disclosed their intent to step down on April 11. This preceded Paramount chief government Bob Bakish’s formal ouster on April 29.

The fund’s legal professionals argued that controlling shareholders are “prohibited from exercising company energy in order to benefit themselves whereas disadvantaging the company.”

Among the many central questions the corporate’s board may have reply in court docket if it’s sued: Is the sale useful for all shareholders or simply Redstone, who could possibly be taking a look at an enormous payout relying on the deal. Minority shareholders, if the take care of Skydance went by way of in the meantime, may’ve been diluted.

Regulation in Delaware, the place Paramount is included, largely defers to controlling shareholders’ potential to evaluate offers. In In Re Synthes Inc. Shareholder Litigation, which handled breach of fiduciary obligation claims towards a controlling shareholder for refusing to contemplate a proposal that might’ve cashed out traders’ stakes within the firm, the court docket discovered that the legislation doesn’t “impose on controlling stockholders an obligation to have interaction in self-sacrifice for the advantage of minority shareholders.” The obligation to prioritize the perfect curiosity of the company and its shareholders, it defined, “doesn’t imply that the controller has to subrogate his personal pursuits in order that the minority stockholders can get the deal that they need.”

However Paramount, if it’s sued, may run right into a current order out of the Delaware Supreme Courtroom that would decide the usual of evaluation in a lawsuit difficult a possible deal. In In re Match Group, Inc. By-product Litigation, the court docket discovered that the take a look at of whole equity — probably the most stringent commonplace of evaluation designed partially to guard minority shareholders — applies normally wherein a controlling shareholder stands on either side of a transaction. For the opposite commonplace of evaluation to use, the transaction should be accepted by an unbiased committee of the board and a majority vote of minority stockholders, it discovered.

Nonetheless, an argument may been made that Redstone was looking for the long run pursuits of minority shareholders. She and different traders may’ve seen Skydance as the perfect accomplice to shepherd the studio previous a tumultuous interval in media and leisure. The David Ellison-led firm is coming off of efficiently reviving the Prime Gun franchise with Paramount and has branched into animated options and video video games. Connections to the Ellison household’s tech know-how (through billionaire Oracle mogul Larry Ellison, David’s father) may’ve helped its streaming platform.

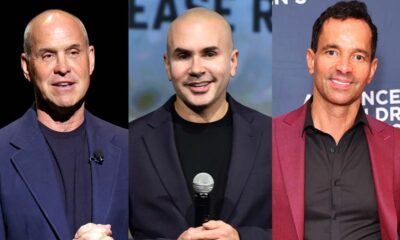

Additionally taking part in a component within the calculus was Redbird, Skydance’s largest shareholder, which is led by chief government Gerry Cardinale. It’s been energetic within the media and leisure house, partnering with Dwayne Johnson and Davy Garcia to purchase the remnants of XFL in 2021 and Epic Video games to purchase a minority stake in SpringHill. Cardinale, who additionally helped strike a deal to amass casting software program agency Expertise Techniques in 2022, may’ve helped leverage Paramount’s mental property.

-

Health2 weeks ago

Humeral shaft fractures: Clinical picture, diagnosis, treatment.

-

Business3 weeks ago

Business3 weeks agoMargarita Howard’s Winning Strategy for HX5 as Prime Contractor and Subcontractor

-

News2 weeks ago

News2 weeks agoWatch: Cat clinging to car door in Dubai flooding scooped up by rescuers

-

News1 week ago

News1 week agoLeBron James rants at NBA’s replay center after Lakers-Nuggets buzzer-beater – NBC Los Angeles

-

Health2 weeks ago

Health2 weeks agoCultivating Healthy Habits for a Positive Lifestyles for Wellness

-

Health2 weeks ago

Health2 weeks agoEssential for Transferring Protective Antibodies to Babies, Bolstering Infant Health

-

News4 weeks ago

News4 weeks agoWhy Tito’s, Southwest and Jack Daniel’s Keep Going Back to Willie Nelson’s ‘Anti-Festival’

-

Bitcoin1 week ago

Apologetic Letter From Former Binance CEO ‘CZ’ Unveiled Ahead Of April 30 Sentencing