Entertainment

Charter Carriage Deal in Focus

Google News Recentlyheard

As a purchaser group led by David Ellison’s Skydance Media goals to iron out a possible deal to take over Paramount World, many eyes on Wall Avenue are additionally watching carriage talks between the leisure conglomerate and cable large Constitution Communications. On April 30, that deal expires.

Final 12 months, Constitution performed hardball with Disney in a negotiating showdown that led to a short blackout final fall earlier than the businesses struck a broad carriage deal overlaying conventional pay TV networks and streaming providers, which finance specialists referred to as a blueprint for future sector agreements and a possible “tipping level” within the relationship between content material and distribution giants.

Relying if, when, how, and what Constitution and Paramount agree on in a brand new pact might have an effect on the worth of Paramount and subsequently its takeover worth goal and its strategic positioning for the longer term. It’s no shock then that trade observers have their eyes and ears peeled for indicators of the way it will play out.

“Constitution took a tough stance towards Disney in September regardless of adversarial timing (in the course of the starting of NFL/CFB seasons) regardless of that ESPN had but to double-dip,” Wolfe Analysis analyst Peter Supino highlighted in a current report. “Neither of those components will profit Paramount, whose streaming service could be bought at a less expensive fee (with all its marquee sports activities) than Constitution at present pays for its portfolio of community.”

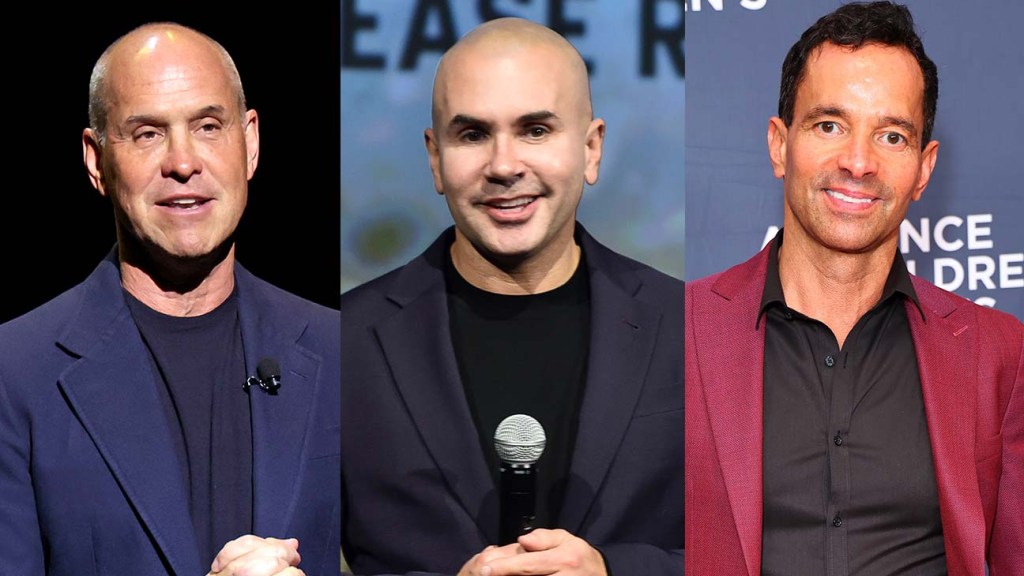

LightShed Companions analysts Richard Greenfield, Brandon Ross and Mark Kelley had already warned in March of doubtless tough seas within the Paramount-Constitution and different carriage talks.

“Whereas we doubt Paramount finally ends up being dropped, we count on very difficult renewals because it has grow to be far much less vital to distributors to hold Paramount, given how little content material is unique to the legacy multichannel bundle,” the LightShed group argued. “And whereas Paramount+ could also be included in any distributor renewal, it is going to seemingly result in a major discount in what distributors pay for current Paramount networks to stop double paying for content material.”

And on condition that Paramount has an enormous array of cable channels tethered to the linear pay TV ecosystem that’s declining, negotiations might get powerful. “Operators could balk on the price ticket for MTV2 in the course of the subsequent spherical of carriage negotiations given the community will not be seen as a must have for subscribers in right this moment’s world the place customers have an enormous array of digital video choices,” S&P World Market Intelligence analyst Scott Robson wrote about Paramount in a report after the Disney-Constitution deal was unveiled final 12 months.

Paramount World CEO Bob Bakish, whose exit from the corporate was made official Monday, “made plans to focus its consideration on six ‘core manufacturers’ in 2017, earlier than the CBS and Viacom merger,” the analyst added. “Since then, the corporate has saved its area of interest networks on air, however that could be altering.”

-

News4 weeks ago

News4 weeks agoWatch Bundesliga Soccer: Livestream Bayern Munich vs. Borussia Dortmund From Anywhere

-

News4 weeks ago

News4 weeks agoNYPD Officer Jonathan Diller wake attended by New York Gov. Kathy Hochul; Baltimore bridge collapse salvage operation underway

-

News4 weeks ago

News4 weeks agoStatement from President Joe Biden on the Wrongful Detention of Evan Gershkovich

-

News4 weeks ago

News4 weeks agoChance Perdomo, ‘Gen V’ star, dies after motorcycle accident at 27

-

News4 weeks ago

FC Barcelona vs. UD Las Palmas TV Channel & Live Stream in the US

-

News4 weeks ago

News4 weeks agoUFL DFS, Week 1: Top DraftKings daily Fantasy football picks, lineup advice from proven expert

-

News4 weeks ago

News4 weeks agoSee Angel Reese play: How to watch today’s LSU vs. UCLA women’s NCAA March Madness Sweet 16 game

-

News4 weeks ago

News4 weeks agoBayern Munich boss Tuchel: Bundesliga race ‘obviously’ over