Thinking about what to do with Salesforce stock these days? You are not alone. Whether you are a long-term holder or just circling the ticker, there have been enough twists lately to give everyone pause. The stock sits at $240.36 after dropping 1.3% over the past week and 6.3% over the last 30 days, with volatility tied closely to a stream of headlines about bold bets on artificial intelligence, operational streamlining, and some big-ticket investments.

Salesforce is making major moves into defense and logistics with its new Missionforce unit, a sign that the company is betting its AI and cloud expertise can unlock fresh sources of revenue. At the same time, the shift toward AI-powered support has meant thousands fewer human roles. This is a dramatic cost-saving step that adds both operational efficiency and new questions about risk going forward. Meanwhile, long-term holders have likely noticed a swing in sentiment, given year-to-date returns of 27.3% and a 16.0% pullback over twelve months, despite a remarkable 61.6% gain since mid-2022.

So, is Salesforce undervalued right now, or is the market justified in its skepticism? By our count, the company scores a 4 out of 6 valuation checks, suggesting there is potential value to uncover here. In the next section, we will break down exactly how those valuation methods stack up and hint at an even more powerful way to think about Salesforce’s worth before you hit buy or sell.

Why Salesforce is lagging behind its peers

Approach 1: Salesforce Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a stock by projecting the business’s future cash flows and discounting them back to their value today. This approach helps investors measure what a company is truly worth, focusing on expectations for long-term growth and profitability rather than short-term market sentiment.

For Salesforce, this model starts with current Free Cash Flow of approximately $12.4 Billion. Analyst estimates cover the next five years. Simply Wall St extends these projections further, anticipating Free Cash Flow to reach nearly $19.4 Billion by 2035. These projections take into account both the company’s historical growth and expected operational shifts in the coming decade.

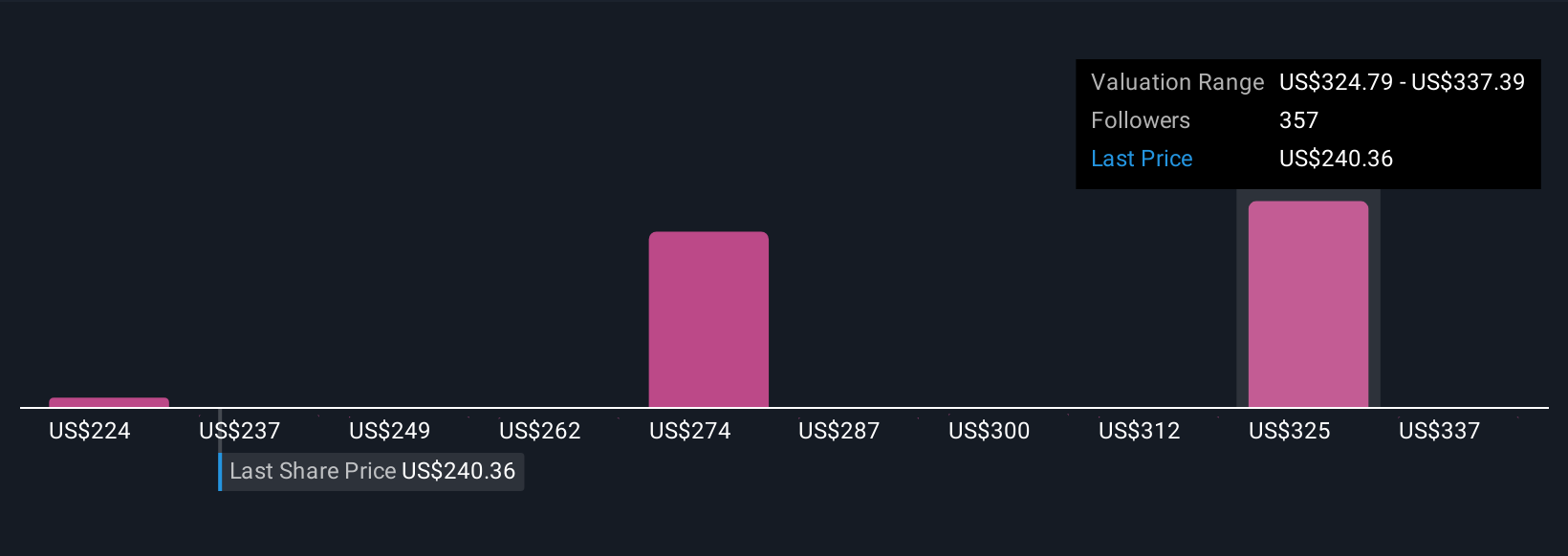

Based on these forecasts and the application of the DCF methodology, Salesforce’s estimated intrinsic value is $280.22 per share. With the current share price at $240.36, the model suggests the stock is trading at a 14.2% discount to its calculated fair value. The DCF indicates that Salesforce’s shares may offer investors potential upside if the company achieves these cash flow targets.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Salesforce.

Our Discounted Cash Flow (DCF) analysis suggests Salesforce is undervalued by 14.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Salesforce Price vs Earnings (P/E Ratio Analysis)

The Price-to-Earnings (P/E) ratio is one of the most widely used measures for valuing profitable companies like Salesforce. It provides a clear snapshot of how much investors are willing to pay today for each dollar of earnings the company generates. For businesses that are solidly in the black, the P/E ratio helps clarify investor expectations regarding future growth, profitability, and business stability.

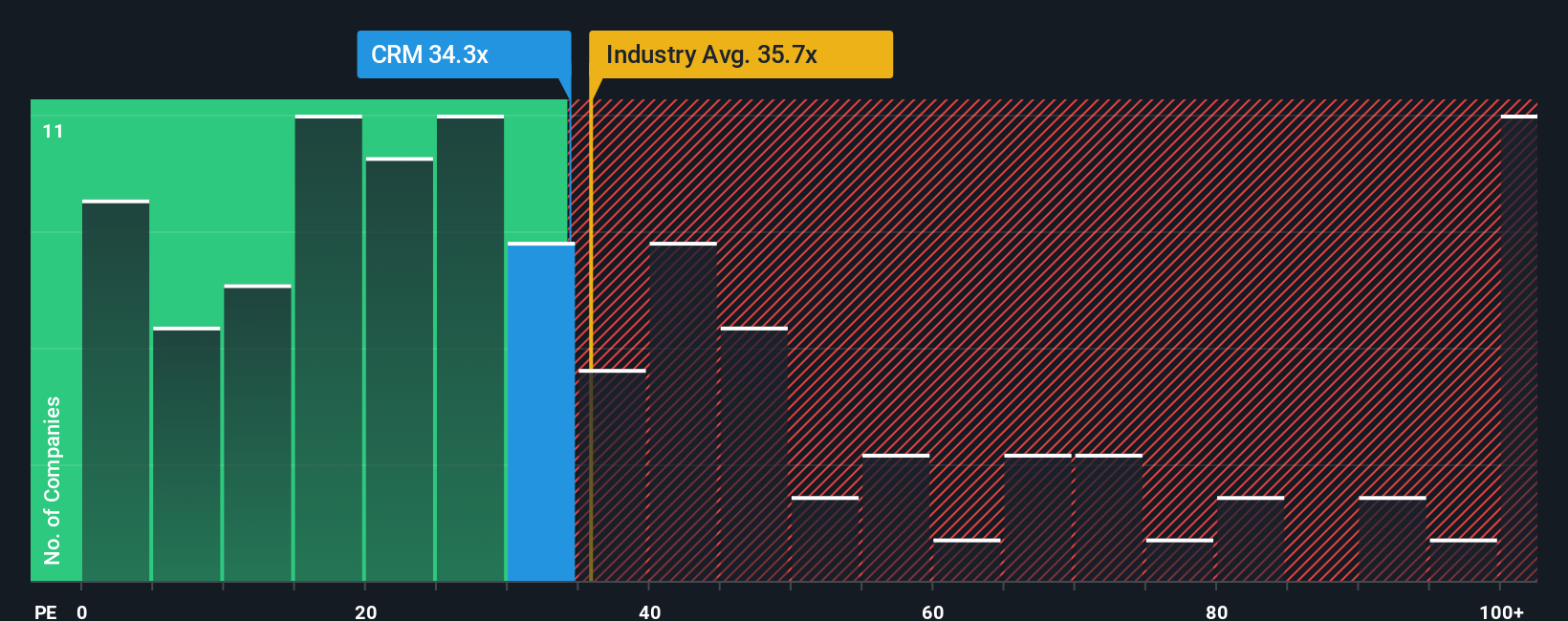

A “normal” or “fair” P/E ratio can vary depending on the company’s growth prospects and perceived risks. High-growth firms or those with lower risk profiles tend to justify higher multiples, while slower-growing or riskier companies often command lower P/E ratios. For Salesforce, the current P/E stands at 34.3x, which is slightly below the software industry average of 35.7x and well below its peer group average of 59.1x.

To add another layer of insight, Simply Wall St calculates a proprietary “Fair Ratio” for Salesforce, which is 43.9x in this case, by factoring in earnings growth, profit margins, industry dynamics, market cap, and company-specific risks. This Fair Ratio is more tailored than a simple peer or industry comparison. It offers an expectation that better reflects all the unique attributes and outlook for Salesforce. Since Salesforce’s actual P/E multiple is meaningfully lower than its Fair Ratio, the stock appears to be trading at a discount using this metric, suggesting possible undervaluation based on current fundamentals and outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Salesforce Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives, a smarter, more dynamic approach to investment decisions. A Narrative lets you combine your perspective on Salesforce’s story with your assumptions about future revenues, margins, and fair value. This creates a personalized outlook that brings together company fundamentals and market sentiment. With Narratives on Simply Wall St’s Community page, you can easily see and build your own story, compare your fair value to the current share price, and adjust your thesis as new news or earnings data arrive. No spreadsheets or complex models are required.

For example, one Salesforce investor may focus on its leadership in enterprise cloud adoption, rapid AI innovation, and strong profitability, producing a narrative with a high price target of $430. A more cautious user could emphasize growing competition, risks around acquisitions, and lower long-term growth, supporting a narrative fair value near $221. Narratives give you the tools to decide when to buy or sell by putting your view side-by-side with others, all dynamically updated as new information emerges.

For Salesforce, we’ll make it really easy for you with previews of two leading Salesforce Narratives:

🐂 Salesforce Bull Case

Fair Value: $334.68

Market is 28.2% below fair value

Revenue Growth Rate: 9.6%

- AI-driven automation and cross-cloud workflow integrations are expanding customer adoption, boosting contract values, and powering sustainable growth.

- Strong execution and disciplined capital returns, with a focus on mid-market and SMB segments, are broadening Salesforce’s customer base and supporting improved margins.

- Key risks include rising competition from tech giants, regulatory challenges, and integration risks from acquisitions. However, long-term revenue and margin expansion opportunities remain intact.

🐻 Salesforce Bear Case

Fair Value: $223.99

Market is 7.3% above fair value

Revenue Growth Rate: 13.0%

- Salesforce’s core growth is slowing as the market matures, and most recent efficiency gains have already been captured. Future upside likely depends on buybacks and capital returns.

- Dependence on large enterprise customers and modest diversification may contribute to volatility if key accounts are lost or industry competition intensifies.

- The market may be overestimating sustainable growth potential. High margins attract competition and AI may both help and commoditize CRM offerings over the next five years.

Do you think there’s more to the story for Salesforce? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Try a Demo Portfolio for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]