Bitcoin

Solana Records ‘Dramatic Increase’ In Institutional Demand

Google News Recentlyheard

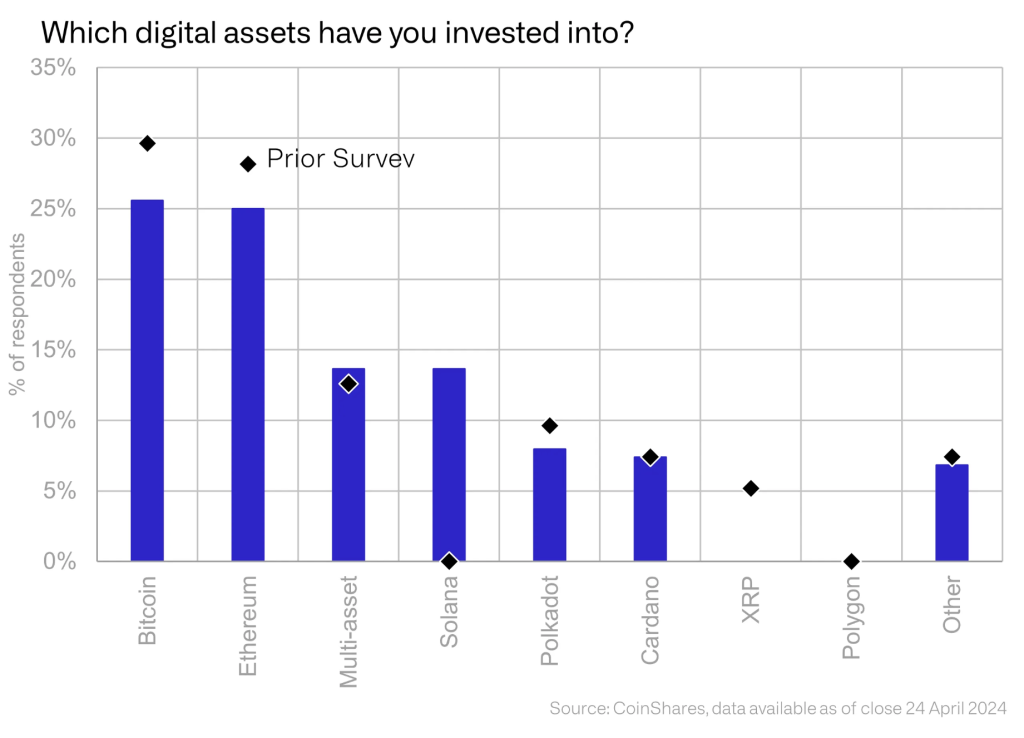

Solana (SOL) has seen a “dramatic improve in allocations” from institutional buyers, in keeping with a current survey performed by CoinShares. The Digital Asset Fund Supervisor Survey, involving responses from 64 buyers managing a cumulative $600 billion in belongings, factors to a burgeoning curiosity in altcoins, with Solana main the cost amongst rising favorites.

Solana See Elevated Demand From Establishments

James Butterfill, Head of Analysis at CoinShares, detailed the findings, stating, “buyers have been broadening their publicity to altcoins, with Solana seeing a dramatic improve in allocations,” highlighting that just about 15% of members now maintain investments in SOL. This marks a big uptrend from earlier surveys, together with January’s outcomes, which confirmed no institutional investments in Solana.

Butterfill emphasised the rising institutional acceptance of Solana, noting its enhanced attraction following current technological developments and elevated market presence. In the meantime, Bitcoin nonetheless leads the market with greater than 25% of respondents having invested within the main cryptocurrency. Simply behind is Ethereum with slightly below 25% as properly.

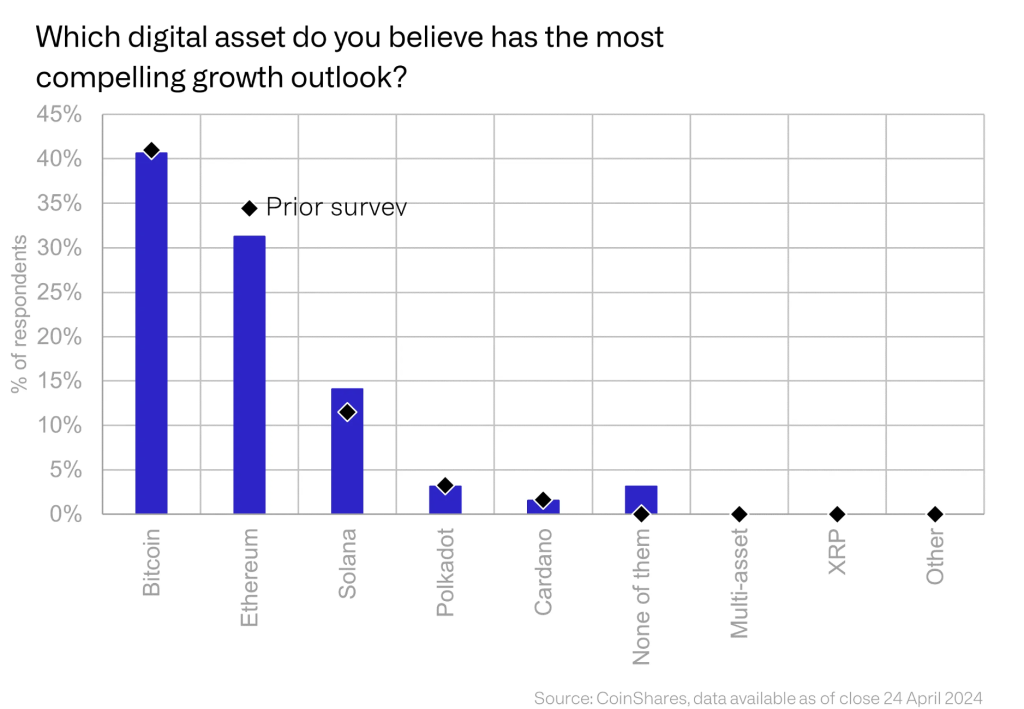

Bitcoin and Ethereum, whereas sustaining their standing because the dominant digital belongings, are experiencing shifts in investor sentiment. Bitcoin stays the popular asset with 41% of buyers bullish on its development outlook, although this can be a slight lower from earlier surveys.

Ethereum has seen a dip in investor confidence, with about 30% of respondents optimistic about its future, down from 35%. This decline in Ethereum’s attract coincides with the rising curiosity in different blockchains like Solana, which supply completely different technological advantages and potential use circumstances.

In distinction, “buyers are extra optimistic for Solana,” the report finds. Round 14% of respondents assume Solana has a promising development outlook, which is greater than the earlier survey’s indication of round 12%.

The survey additionally sheds mild on the general composition of digital asset investments. Digital belongings now symbolize 3% of the typical funding portfolio, the very best stage recorded for the reason that inception of the survey in 2021. This improve is attributed considerably to the introduction of US spot Bitcoin ETFs, which have allowed institutional buyers direct publicity to Bitcoin with out the complexities of direct cryptocurrency holdings.

Regardless of the optimistic inflow of institutional capital into cryptocurrencies like Solana, the report reveals that substantial obstacles nonetheless impede broader adoption. Regulation stays a big concern, with many buyers citing it as a key impediment to additional funding within the asset class. In response to Butterfill, “Regulation stays stubbornly excessive as a barrier, but it’s encouraging to see that considerations over volatility and custody proceed to decrease.”

Moreover, the survey highlighted that whereas investor curiosity in distributed ledger know-how stays excessive, the notion of cryptocurrencies as a superb worth funding has elevated notably. From January to April, the share of buyers who view digital belongings as “good worth” jumped from beneath 15% to over 20%, pushed by growing shopper demand and optimistic worth momentum.

Wanting forward, the report means that the panorama for digital belongings is evolving quickly. As institutional buyers proceed to diversify their portfolios and search publicity to progressive applied sciences, altcoins like Solana are more likely to acquire additional traction. Nevertheless, the tempo of adoption will rely closely on developments in regulatory frameworks and the broader financial setting, which proceed to pose challenges and alternatives for buyers within the area.

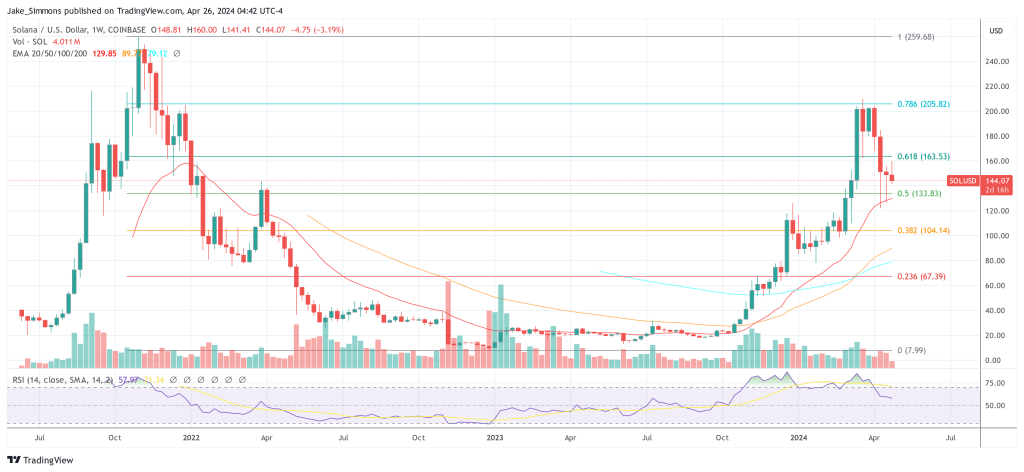

At press time, Solana traded at $144.07.

Featured picture from LinkedIn, chart from TradingView.com

-

News4 weeks ago

News4 weeks agoBrazil player ratings vs Spain: Endrick scores again after Lamine Yamal runs Selecao ragged as world’s best wonderkids put on a show

-

News4 weeks ago

News4 weeks agoEngland 2-2 Belgium (Mar 26, 2024) Game Analysis

-

News4 weeks ago

News4 weeks agoThe Fisker Ocean EV Is Dirt Cheap. Don’t Buy One.

-

News4 weeks ago

News4 weeks agoGoogle’s Sergey Brin Convinced Employee to Reject OpenAI Offer

-

News4 weeks ago

News4 weeks agoCowboys hope to extend QB Dak Prescott despite no offers, imminent talks on new long-term deal

-

News4 weeks ago

News4 weeks agoTruth Social’s stock price is up. Who’s investing in Trump’s platform?

-

News4 weeks ago

News4 weeks agoCowboy Carter Review: Every Thought We Had While Listening to Beyoncé’s New Album

-

News4 weeks ago

News4 weeks agoNinja Reveals Skin Cancer Diagnosis: Professional Gamer in ‘Shock’