Bitcoin

Bloomberg’s Mike McGlone Reveals Why A $150,000 Bitcoin Price Target Is Far Off

Google News Recentlyheard

Mike McGlone, Senior commodity strategist at Bloomberg Intelligence, has made a somewhat pessimistic prediction for Bitcoin, emphasizing that the cryptocurrency’s potential rise to $150,00 was a protracted shot. The strategist has revealed components that might make Bitcoin’s projected surge to $150,000 troublesome, highlighting each macroeconomic traits and Bitcoin’s efficiency in 2024.

Bitcoin Surge To $150,000 Unlikely

In a latest interview with Scott Melker, the host of “The Wolf Of All Streets,” podcast, McGlone mentioned Bitcoin’s worth fundamentals and its attainable rise to $150,000 within the 2024 bull cycle.

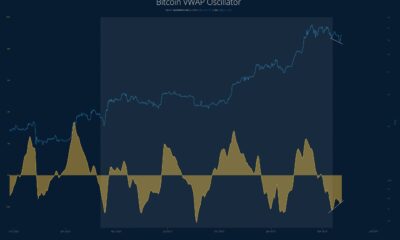

Evaluating Bitcoin with the inventory market index, the S&P 500, the Bloomberg strategist disclosed that the cryptocurrency was presently exhibiting “divergent weak spot,” highlighting that Bitcoin’s efficiency towards the S&P 500 in 2021 was larger in comparison with 2024.

He additionally revealed that Bitcoin was displaying an analogous weak efficiency to Gold, emphasizing present market situations and the chance of short-term deflation within the monetary market.

The mixture of those components pushes McGlone to imagine that Bitcoin’s short-term projected rise to $150,000 was unlikely.

Whereas the Bloomberg strategist made his foreboding prediction regardless of Bitcoin’s overperformance at the start of the 12 months, McGlone nonetheless stays optimistic about the cryptocurrency’s worth and elementary worth in the long run.

Co-founder and CEO of CoinRoutes, Dave Weisberger, who was additionally within the podcast with McGlone, made a extra optimistic prediction for Bitcoin. Basing his evaluation on historic traits and patterns way back to 2015, Weisberger forecasted that Bitcoin may rise to $200,000 this cycle.

His forecast can be acknowledged by reformed hedge fund supervisor, James Lavish, who revealed within the podcast that Spot Bitcoin ETFs may turn into a possible driver for Bitcoin’s steady progress. That is attributed to the huge affect Bitcoin ETFs had on the cryptocurrency’s worth following its launch on January 11, 2024.

After Spot Bitcoin ETFs have been efficiently launched into the market, the value of Bitcoin skyrocketed to new all-time highs above $73,000. On the time of writing, the cryptocurrency is buying and selling at $63,778, marking a 0.89% enhance over the previous seven days, in response to CoinMarketCap.

BTC Crash Presents Excellent Alternative

In response to Lavish, if Bitcoin crashes down to the $30,000 to $40,000 vary, it will current a “large alternative” for traders to purchase substantial worth in a long-term asset that can basically maintain its worth and proceed to understand sooner or later.

The reformed hedge fund supervisor revealed that Bitcoin’s short-term volatility and market unpredictability may produce long-term seize of worth. This means that by strategically navigating by way of the value fluctuations of Bitcoin, traders may doubtlessly capitalize on its volatility to build up wealth over time, which in flip may favorably affect the value of the cryptocurrency.

BTC bears and bulls proceed tug of conflict | Supply: BTCUSD on Tradingview.com

Featured picture from ETF Stream, chart from Tradingview.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use info supplied on this web site fully at your personal threat.

-

Health2 weeks ago

Humeral shaft fractures: Clinical picture, diagnosis, treatment.

-

Business4 weeks ago

Business4 weeks agoMargarita Howard’s Winning Strategy for HX5 as Prime Contractor and Subcontractor

-

News3 weeks ago

News3 weeks agoWatch: Cat clinging to car door in Dubai flooding scooped up by rescuers

-

News2 weeks ago

News2 weeks agoLeBron James rants at NBA’s replay center after Lakers-Nuggets buzzer-beater – NBC Los Angeles

-

Health2 weeks ago

Health2 weeks agoCultivating Healthy Habits for a Positive Lifestyles for Wellness

-

Health2 weeks ago

Health2 weeks agoEssential for Transferring Protective Antibodies to Babies, Bolstering Infant Health

-

News2 weeks ago

News2 weeks agoPet Shop Boys know the secret to staying cool, four decades in

-

Business2 weeks ago

Business2 weeks agoUtilizing Personalized Video Marketing for Targeted Advertising