Bitcoin

Bitcoin Whales, Not Retailers, Are Safe If The United States Government Begins Confiscating Coins: Analyst

Google News Recentlyheard

Willy Woo, an on-chain analyst, took to X on April 29, raising considerations in regards to the destiny of retail Bitcoin buyers if the world, particularly america, plunges right into a recession.

Woo, referencing historic occasions, argues that whereas massive Bitcoin holders, or “whales,” are more likely to climate the storm since they management personal keys of their cash, retailers or on a regular basis BTC buyers would possibly face a distinct actuality.

Who Will Be Secure If The US Authorities Started Confiscating Bitcoin?

The analyst compares the present market and the financial downturn of the Nice Despair of 1930. Throughout that point, america authorities, Woo warned, seized gold from the general public to replenish nationwide reserves.

Woo now raises the query of whether or not an identical state of affairs may unfold with Bitcoin. If that’s the case, it may doubtlessly result in extra extreme penalties for retail buyers.

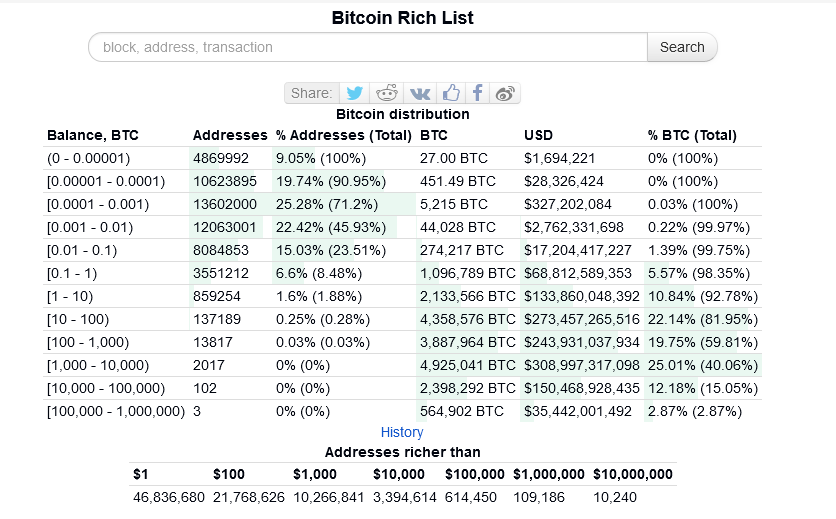

Whether or not the federal government will succeed or not will largely rely upon one essential issue: Bitcoin storage. Sharing information, Woo notes {that a} staggering 87% of Bitcoin is held in self-custody wallets. As an example, by way of these wallets, just like the Samourai pockets, people management their personal keys, which means they’ll signal transactions, proving that they personal cash.

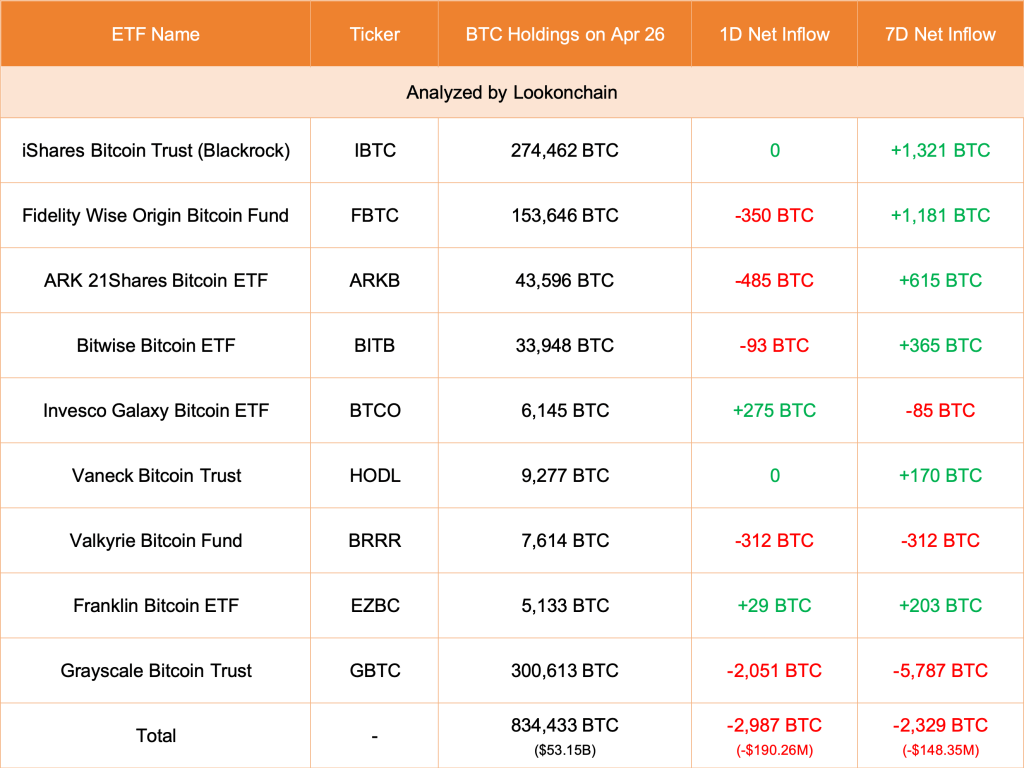

In the meantime, roughly 1% are held by spot Bitcoin exchange-traded fund (ETF) issuers like Constancy. Spot ETF issuers, particularly from america, providing aggressive and low charges, have been quickly shopping for BTC from a number of sources, together with by way of exchanges and over-the-counter (OTC) markets, to fulfill the rising demand from buyers, together with establishments.

In response to Lookonchain data, by April 26, all spot Bitcoin ETF customers held over 834,000 BTC lower than three months after launching.

Then again, 12% of all BTC sits on exchanges like Binance, Kraken, and Coinbase. Most of those cash belong to buyers or merchants who actively have interaction. Via centralized exchanges, BTC holders, although not accountable for their coin’s personal keys, can liquidate for altcoins like Cardano, fiat like USD, and even stablecoins.

United States Inflation Rising, GDP Information Comfortable: Recession Incoming?

Whereas most BTC is held by way of non-custodial wallets, Woo stated this route is taken primarily by way of whales. Then again, most retailers fall within the 12% class, protecting their cash by way of centralized exchanges. This distinction, Woo continues, turns into essential throughout financial turmoil.

Nonetheless, it stays unclear who a whale is, per Woo’s categorization. Bitinfocharts information on April 29 reveals that over 65% of BTC is within the palms of those that management lower than 0.1 BTC or retailers.

Some analysts fear that rising inflationary costs in america and falling actual GDP, as financial information reveals, would possibly plunge the nation right into a recession. For now, eyes shall be on the Federal Reserve (Fed) and Jerome Powell once they set the nation’s rate of interest this week.

Function picture from Canva, chart from TradingView

-

News4 weeks ago

News4 weeks agoUFL DFS, Week 1: Top DraftKings daily Fantasy football picks, lineup advice from proven expert

-

News4 weeks ago

News4 weeks agoSee Angel Reese play: How to watch today’s LSU vs. UCLA women’s NCAA March Madness Sweet 16 game

-

News4 weeks ago

Astros vs. Yankees Predictions & Picks

-

News4 weeks ago

News4 weeks agoUSC Women’s Basketball Is On To The Elite Eight!

-

News4 weeks ago

News4 weeks agoAT&T notifies users of data breach and resets millions of passcodes

-

News4 weeks ago

News4 weeks agoWBB’s NCAA Tournament run ends with loss to top-seeded USC

-

News4 weeks ago

News4 weeks agoReid Detmers leads Angels pitching staff to series-salvaging victory over Orioles – Orange County Register

-

News4 weeks ago

News4 weeks agoMultiple FCS Players Featured Across New League