Bitcoin

Bitcoin Price Prediction: MicroStrategy Loses $53.1 Million In Q1 But Still Buys BTC As Experts Say This Learn-To-Earn Crypto Might 10X

Google News Recentlyheard

Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin value is up nearly 1.5% previously 24 hours to commerce for $63,258 as of 01:54 a.m. EST.

Buying and selling quantity surged 38%, maybe resulting from spot Bitcoin and Ethereum exchange-traded funds (ETFs) itemizing on the Hong Kong Inventory Trade right now.

The three Hong Kong spot #Bitcoin ETFs are going to begin buying and selling in a couple of hours. They’re able to go on Bloomberg/@TheTerminal pic.twitter.com/SSCB09p57b

— James Seyffart (@JSeyff) April 29, 2024

Within the speedy aftermath of the Hong Kong BTC ETFs going reside, the Bitcoin value rose by $600, with studies indicating that it recorded as much as $6.3 million in quantity.

Hong Kong opens for #Bitcoin ETF enterprise and we’re up $600 bucks in a matter of minutes. Lets hope it is a good harbinger of hardness . pic.twitter.com/zqnpiz3oBp

— InvestAnswers (@invest_answers) April 29, 2024

Elsewhere, the most important company holder of Bitcoin, MicroStrategy, has reported a web lack of $53.1 million within the first quarter (Q1) of 2024. Regardless of that, it continues shopping for BTC.

MicroStrategy Dedicated To Shopping for Extra Bitcoin Regardless of Q1 Web Loss Hitting $53.1M

The web loss was the results of the corporate recording a $191.6 million digital asset impairment loss within the first quarter. This was 10X larger than the earlier 12 months, with revenues falling 5.5% relative to Q1 of 2023 to hit $115.2 million.

MicroStrategy has not but adopted the brand new digital asset truthful worth accounting commonplace. If they’d, the usual would have accommodated the 65% improve in market worth that BTC has recorded within the quarter.

Because of this, the agency’s carrying worth of BTC was marked at $5.07 billion at $23,680 per Bitcoin. That is primarily based on the standard accounting mannequin. The truthful worth strategy would have reached as excessive as $15.2 billion.

Nonetheless, MicroStrategy nonetheless purchased a further 122 BTC for $7.8 million in April. This brings MicroStrategy’s complete Bitcoin bucket to 214,400 Bitcoin, value $13.5 billion. The typical buy value is $35,180.

In April, @MicroStrategy acquired a further 122 BTC for $7.8 million and now holds 214,400 BTC. Please be part of us at 5pm ET as we talk about our Q1 2024 monetary outcomes and reply questions concerning the outlook for #BusinessIntelligence and #Bitcoin. $MSTR https://t.co/h40yyrgEb0

— Michael Saylor⚡️ (@saylor) April 29, 2024

Bitcoin Worth Outlook

The Bitcoin value is range-bound, buying and selling sideways as a part of a horizontal chop. The chances favor the draw back, contemplating the Relative Power Index (RSI) is subdued beneath the imply degree of fifty. The identical is seen with the Superior Oscillator (AO), which is caught in unfavorable territory.

Whereas the bulls battle to defend the world round $62,000 to $63,000, it’s not possible to disregard the very fact that there’s a lot of bearish strain ready to descend on BTC as soon as the value crosses above the $65,600 threshold.

If the bears have their means, the Bitcoin value might drop into the liquidity pool that extends from $60,600 to the March 5 low of $59,005.

In a dire case the place the pool of liquidity fails to carry as help, the Bitcoin value might roll over to the $52,000 space the place a big herd of BTC bulls is ready to work together with the Bitcoin value. This could be a attainable turnaround level and entry for the late bulls.

TradingView: BTC/USDT 1-day chart

On the flip facet, if the bulls have their means, Bitcoin value might push north. To invalidate the bearish thesis, nevertheless, the value should ascend previous $70,000, to report a candlestick shut above $72,000. It is because there’s additionally a big herd of bears round this threshold, as proven by the gray spikes on the amount profile.

On-chain Metrics For Bitcoin Worth

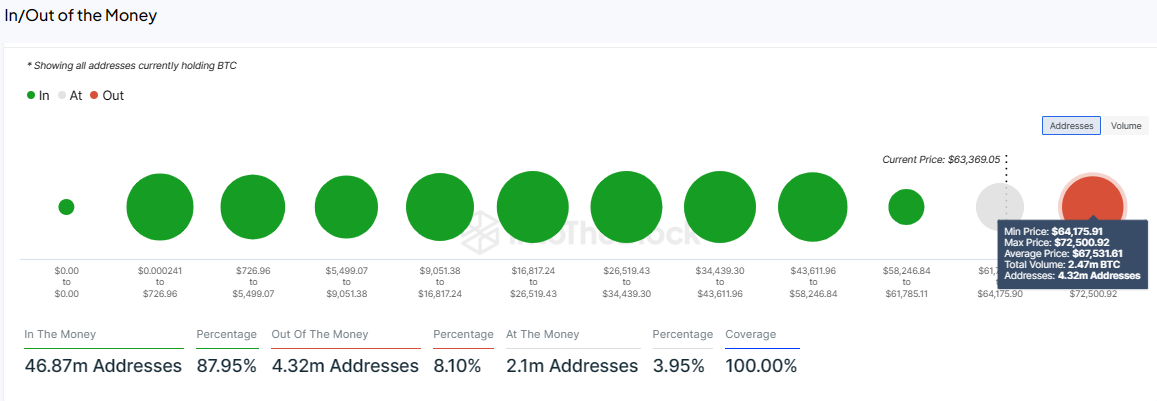

Information in keeping with IntoTheBlock exhibits that Bitcoin value might face important resistance within the vary between $64,175 and $72,500. Inside this bracket, 4.32 million addresses maintain roughly 2.47 million BTC tokens bought at a mean value of $67,531. Any efforts to push the BTC value excessive could be countered by this many addresses.

BTC IOMAP

In the meantime, many traders are contemplating shifting to 99BTC, a learn-to-earn cryptocurrency that analysts say might 10X at launch. Its presale has already raised nearly $1 million.

Promising Various To Bitcoin

At the same time as Hong Kong BTC ETFs go reside on the Inventory Trade, and with MicroStrategy dedicated to rising its BTC portfolio, 99Bitcoins is the most recent sensation amongst Bitcoin-inspired initiatives.

It’s an academic platform dedicated to monetizing training for finish customers. To this finish, it leverages its pioneering new Be taught-to-Earn rewards mannequin, the place customers get pleasure from prime in-class instructional assets.

🌟📚 Begin Your $99BTC Journey with Our Free Crash Course! 🌟🎓

Over 100,000 college students have loved our course, receiving each day emails with important $BTC alpha. ✅

From over 750 contributors, it is designed to be quick, candy, and tremendous instructional!

👉 https://t.co/PepIrsQGUi pic.twitter.com/UohphNbGbS

— 99Bitcoins (@99BitcoinsHQ) April 29, 2024

The mission traces again to 2013, 4 years after Bitcoin’s 2009 launch, and two earlier than Ethereum arrived. Beginning out as BitcoinWithPayPal.com, it’s now transitioning to Web3 with its $99BTC token.

Unique entry to superior modules is on the market for $99BTC token holders. 🏆

Dive into matters from subtle buying and selling methods to in-depth #Blockchain know-how purposes.

Be part of the #Presale now!

👉 https://t.co/NXD7DAamqr#99Bitcoins #Bitcoin #CryptoNews pic.twitter.com/M5p0dtDc9f— 99Bitcoins (@99BitcoinsHQ) April 28, 2024

99Bitcoins incentivizes studying by means of a singular mixture of gamification and a leaderboard reward system. This ensures customers really feel like their studying is bearing tangible and due to this fact spendable advantages. Mainly, you earn crypto whereas studying about crypto.

Our #Learn2Earn platform is on the coronary heart of our mission to coach. 🤝

You’ll be capable to dive into a wide selection of matters, from #Blockchain fundamentals to superior buying and selling methods, all whereas unlocking rewards!

Uncover Extra: https://t.co/NXD7DAamqr#99Bitcoins #CryptoNews $BTC pic.twitter.com/l9sjDsjOAb

— 99Bitcoins (@99BitcoinsHQ) April 27, 2024

Out of a complete of 99 billion 99BTC tokens, 15% have been put aside to be bought over the course of a fourteen-round presale. The target is to boost the funds required to expedite cutting-edge growth across the mission’s BRC-20 integration.

🚀 #99Bitcoins milestone alert! 🚀

We have surpassed 900K in our $99BTC #Presale! 🔥

With stage 3 ending in simply 1 day, now’s the time to safe your tokens!

Be part of our presale now!

👉 https://t.co/NXD7DAamqr#AltSeason #CryptoCurrency #BTC pic.twitter.com/51pCWPJjEP— 99Bitcoins (@99BitcoinsHQ) April 29, 2024

You may as well stake your 99BTC holdings for an annual yield of 1,983%. To this point, upwards of 549 million 99BTC tokens have been staked.

Stake your $99BTC tokens right now and begin receiving rewards! ⭐️

This not solely secures the community but in addition contributes to the platform’s liquidity. 🔐

Be taught Extra: 👉 https://t.co/NXD7DAamqr#99Bitcoins #BlackRock $BTC $ETH pic.twitter.com/fx8o9zj4Zj

— 99Bitcoins (@99BitcoinsHQ) April 29, 2024

99BTC tokens promote for $0.00102, however that value will change quickly. So, in case you are , purchase quickly.

Go to and purchase 99Bitcoins right here.

Additionally Learn:

99Bitcoins (99BTC) – New Be taught To Earn Token

- Audited By Stable Proof

- Established Model – Based In 2013

- Free Airdrop – Win A Share Of $99,999

- Be taught To Earn – Get Paid To Full Buying and selling Programs

- 700,000+ YouTube Group

Be part of Our Telegram channel to remain updated on breaking information protection

-

Health2 weeks ago

Humeral shaft fractures: Clinical picture, diagnosis, treatment.

-

Business3 weeks ago

Business3 weeks agoMargarita Howard’s Winning Strategy for HX5 as Prime Contractor and Subcontractor

-

News2 weeks ago

News2 weeks agoWatch: Cat clinging to car door in Dubai flooding scooped up by rescuers

-

News1 week ago

News1 week agoLeBron James rants at NBA’s replay center after Lakers-Nuggets buzzer-beater – NBC Los Angeles

-

Health2 weeks ago

Health2 weeks agoCultivating Healthy Habits for a Positive Lifestyles for Wellness

-

Health2 weeks ago

Health2 weeks agoEssential for Transferring Protective Antibodies to Babies, Bolstering Infant Health

-

Bitcoin1 week ago

Apologetic Letter From Former Binance CEO ‘CZ’ Unveiled Ahead Of April 30 Sentencing

-

Health2 weeks ago

Health2 weeks ago7 Ways to Boost your Stamina Naturally as per Ancient Ayurveda