Bitcoin

Bitcoin HODLer Profit-Taking Exhausts: Green Sign For Rally?

Google News Recentlyheard

On-chain knowledge exhibits the Bitcoin long-term holders have lastly cooled off their profit-taking after displaying a wild selloff simply earlier.

Bitcoin Coin Days Destroyed Has Calmed Down For BTC Not too long ago

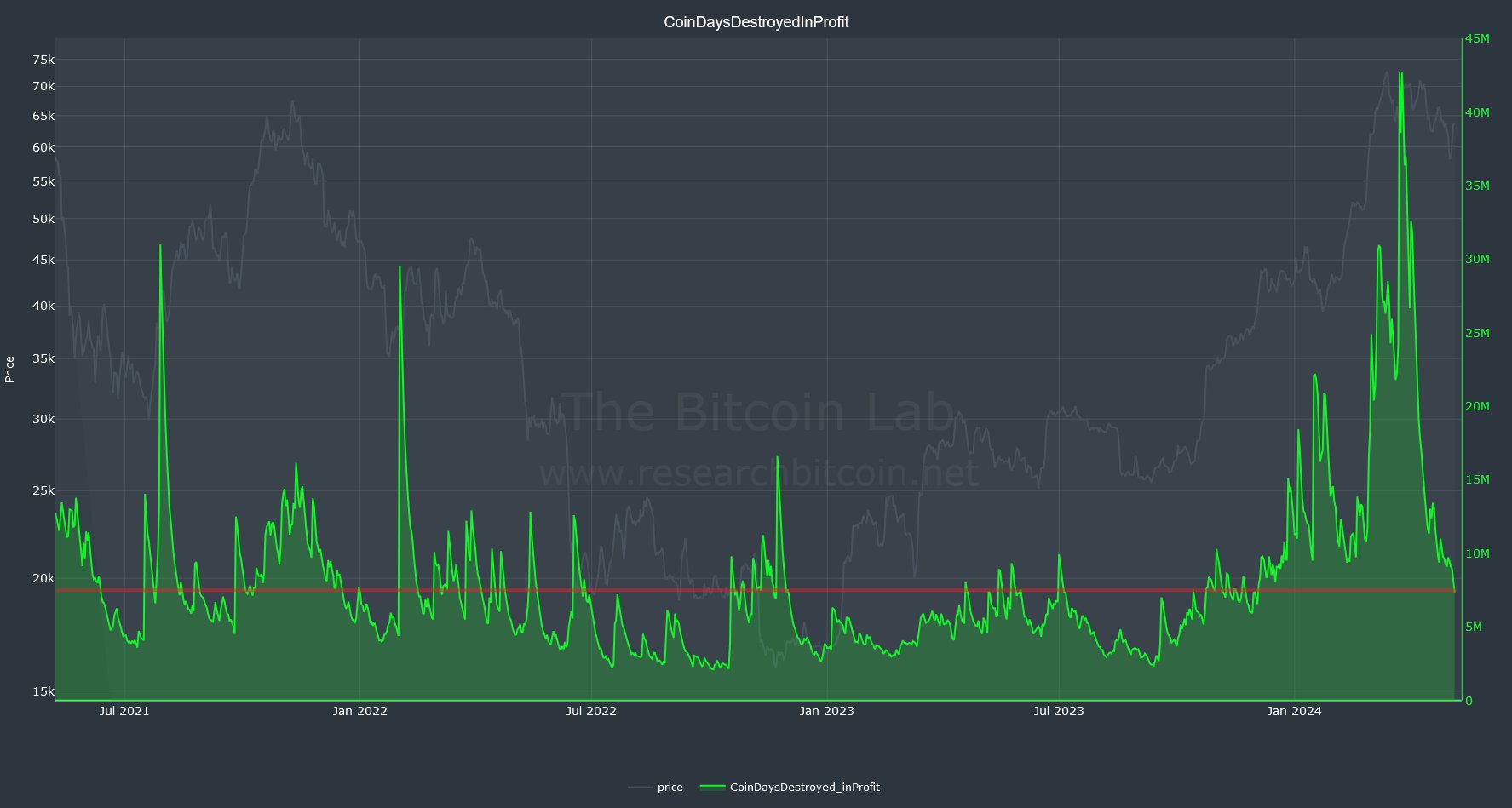

As identified by BTC on-chain analysis account “The Bitcoin Researcher” in a post on X, the Coin Days Destroyed In Revenue metric has declined not too long ago. A “coin day” is a amount that 1 BTC accumulates after staying dormant on the blockchain for 1 day. Thus, when a coin sits nonetheless in the identical tackle for some time, it carries some variety of coin days.

When a coin like that is lastly moved on the community, its coin days rely resets again to zero, and the coin days that it had been holding are stated to be “destroyed.” The Coin Days Destroyed (CDD) retains observe of the entire quantity of coin days being destroyed on this method throughout the blockchain on any given day. When the worth of this indicator spikes, it signifies that numerous aged cash are on the transfer.

These spikes are attributed to the “long-term holders,” buyers who usually are likely to HODL onto their cash for prolonged intervals. This group holds massive coin days, so their strikes find yourself resulting in a destruction of a considerable amount of them.

Giant strikes from these buyers, although, will not be that frequent, as they’re by nature HODLers who stay tight regardless of no matter could also be happening within the wider market. When the LTHs do break their dormancy, it’s usually for promoting, so spikes within the CDD might correspond to promoting stress arising from this group.

Within the context of the present matter, profit-taking from these buyers particularly is of curiosity, so the analyst has cited the CDD knowledge for under the cash that had been carrying a revenue previous to the transfer.

Right here is the chart for this Bitcoin indicator over the previous couple of years:

The worth of the metric seems to have registered a drawdown in current weeks | Supply: @ResearchBTCNow on X

As displayed within the above graph, the Bitcoin CDD In Revenue had risen to some very excessive ranges earlier because the BTC rally in direction of the brand new all-time excessive had taken place.

This extraordinary spike would counsel that the run had enticed even these diamond arms into harvesting their earnings. Because the asset’s drawdown publish this rally has performed out, although, the metric’s worth has declined, suggesting a lower in promoting stress from the LTHs.

The ‘CDD In Revenue’ has now come all the way down to comparatively low ranges, though its worth remains to be increased than through the bear market. Given this development, it’s attainable that the LTH profit-taking might have been exhausted for now, or no less than is near being so.

It now stays to be seen how the Bitcoin worth develops from right here, as maybe one of many principal obstacles to the rally is now out of the asset’s means.

BTC Worth

Bitcoin’s restoration surge has slowed down over the previous couple of days because the asset’s worth has continued to consolidate across the $64,000 degree.

Seems like the value of the asset has total registered a soar up to now 5 days | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, researchbitcoin.web, chart from TradingView.com

-

Health2 weeks ago

Humeral shaft fractures: Clinical picture, diagnosis, treatment.

-

Business4 weeks ago

Business4 weeks agoMargarita Howard’s Winning Strategy for HX5 as Prime Contractor and Subcontractor

-

News3 weeks ago

News3 weeks agoWatch: Cat clinging to car door in Dubai flooding scooped up by rescuers

-

News2 weeks ago

News2 weeks agoLeBron James rants at NBA’s replay center after Lakers-Nuggets buzzer-beater – NBC Los Angeles

-

Health2 weeks ago

Health2 weeks agoCultivating Healthy Habits for a Positive Lifestyles for Wellness

-

Health2 weeks ago

Health2 weeks agoEssential for Transferring Protective Antibodies to Babies, Bolstering Infant Health

-

Health2 weeks ago

Health2 weeks ago7 Ways to Boost your Stamina Naturally as per Ancient Ayurveda

-

Bitcoin2 weeks ago

Bitcoin2 weeks ago🔴 The Next Big Coin?