Bitcoin

Australian Court Gives Win To Watchdog

Google News Recentlyheard

Latest experiences revealed that the Australian Securities and Funding Fee (ASIC) was granted its first victory on a non-cash fee case involving cryptocurrencies. Per the paperwork, an Australian courtroom dominated partially in favor of the watchdog’s lawsuit towards BPS Monetary Pty Ltd (BPS).

“Qoin Scheme” Earns $26 Million In Gross sales

In 2022, ASIC initiated civil penalty procedures towards BPS for alleged “deceptive, false or misleading” promoting and interesting in unlicensed operations with a non-cash fee facility involving a crypto asset token.

The Australian regulator claimed that the Qoin Facility was a “non-cash fee facility” established by the corporate in 2020. The “Qoin scheme” included the Qoin tokens, the Qoin Pockets, and a distributed digital ledger carried out by blockchain know-how.

Furthermore, ASIC alleged that BPS promoted the tokens to retail shoppers and enterprise house owners as a fee methodology for “items and companies supplied by Qoin Retailers.”

Nonetheless, the tokens may solely be traded on the BTX Trade, operated by Block Commerce Trade Pty Ltd (BTX), an organization underneath BPS. The crypto change seemingly solely allowed buying and selling Qoin tokens for Australian {dollars}, and over time, it allegedly imposed restrictions that restricted the power to change the token.

In keeping with the press launch, the Qoin Pockets had over 93,000 customers by September 2022. Moreover, it obtained over AU$40 million, round $26.5 million, from Qoin token gross sales.

Courtroom Guidelines In Favor Of Watchdog

On Might 3, 2024, the Australian Federal Courtroom discovered that BPS was responsible of a lot of the fees leveled by ASIC. Decide J Downes dominated that the corporate “engaged in unlicensed conduct when providing the ‘Qoin Pockets,’ a non-cash fee facility which used a crypto-asset token.”

Decide Downes thought of that BPS broke the Firms Act for at the very least 10 months in 2020 because it didn’t maintain an Australian Monetary Companies License. In consequence, the corporate was not approved to “challenge or present recommendation concerning the Qoin Pockets.”

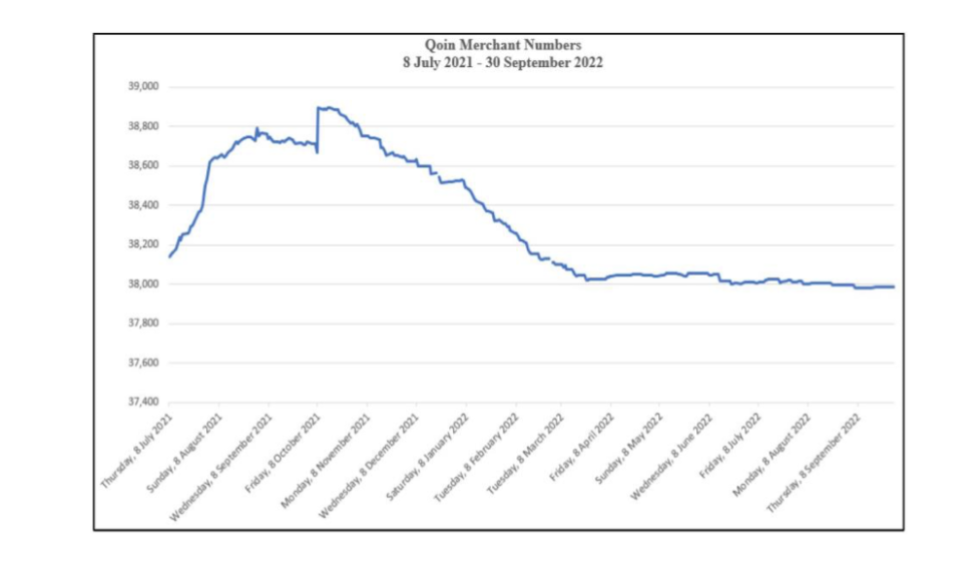

Furthermore, the choose discovered that the corporate engaged in deceptive advertising and marketing and illustration of the product. The explanations for this ruling embrace BPS’s false claims that the Qoin Pockets was formally registered and that stated pockets could possibly be used to buy items and companies from an “rising variety of Qoin Retailers” when it was declining.

Qoin Product owner's decresing numbers over time. Supply: ASIC

Moreover, the Courtroom discovered that the one crypto change that accepted Qoin earlier than November 2021 was the BTX change. This contradicted the claims that Qoin tokens could possibly be traded for different crypto belongings or AUD from totally different exchanges.

Clearer Regulatory Framework For Crypto?

ASIC Chair Joe Longo deems this “a big ruling as the primary courtroom consequence towards a non-cash fee facility involving crypto.” Nevertheless, the Courtroom didn’t agree with all of ASIC’s arguments towards BPS.

In keeping with the official doc, Decide Downes disagreed with the regulator’s declare that the Qoin Pockets and the Qoin Blockchain had been one single scheme as a part of the Qoin Facility:

Opposite to ASIC’s submissions, the Qoin Blockchain, a method of buying Qoin and a method whereby enterprise operators who maintain Qoin Wallets can register as Qoin Retailers should not elements of, and should not themselves, the mechanism which permits the person to make the non-cash fee.

The Courtroom’s rejection turns into a vital ruling towards the regulator’s try and classify blockchain know-how as a monetary product underneath Australian legislation. In keeping with ASIC’s Chair, the company has taken a number of enforcement actions towards crypto asset companies “with the intention of clarifying what’s a regulated product and when the supplier wants a license.”

Lastly, Longo added that the enforcements are meant as a message to the crypto neighborhood:

These proceedings ought to ship a message to the crypto business that their merchandise will proceed to be scrutinized by ASIC to make sure shoppers are protected and that they adjust to regulatory obligations.

Complete crypto market capitalization is at $2.3 trillion within the weekly chart. Supply: TOTAL on TradingView

Featured Picture from Unsplash.com, Chart from TradingView.com

-

Health2 weeks ago

Humeral shaft fractures: Clinical picture, diagnosis, treatment.

-

Health2 weeks ago

Health2 weeks agoCultivating Healthy Habits for a Positive Lifestyles for Wellness

-

Health2 weeks ago

Health2 weeks agoEssential for Transferring Protective Antibodies to Babies, Bolstering Infant Health

-

Business4 weeks ago

Business4 weeks agoMargarita Howard’s Winning Strategy for HX5 as Prime Contractor and Subcontractor

-

News3 weeks ago

News3 weeks agoWatch: Cat clinging to car door in Dubai flooding scooped up by rescuers

-

News2 weeks ago

News2 weeks agoLeBron James rants at NBA’s replay center after Lakers-Nuggets buzzer-beater – NBC Los Angeles

-

Business2 weeks ago

Business2 weeks agoUtilizing Personalized Video Marketing for Targeted Advertising

-

News3 weeks ago

News3 weeks agoSenate kills articles of impeachment against Alejandro Mayorkas