Amica Insurance is a sponsor of “Good Morning America.”

September marks National Life Insurance Awareness Month, and experts say it’s a good time to remember that many families are leaving themselves financially vulnerable, and that coverage is more affordable than you might think.

A story that hits close to home

For Vinny Fiorino, senior assistant vice president at Amica Insurance, the importance of life insurance is more than professional, it’s personal.

At 29, as he and his wife prepared to welcome their first child, they decided to wait before applying for life insurance coverage. Just months into the pregnancy, his wife was diagnosed with cancer, making her ineligible for a policy.

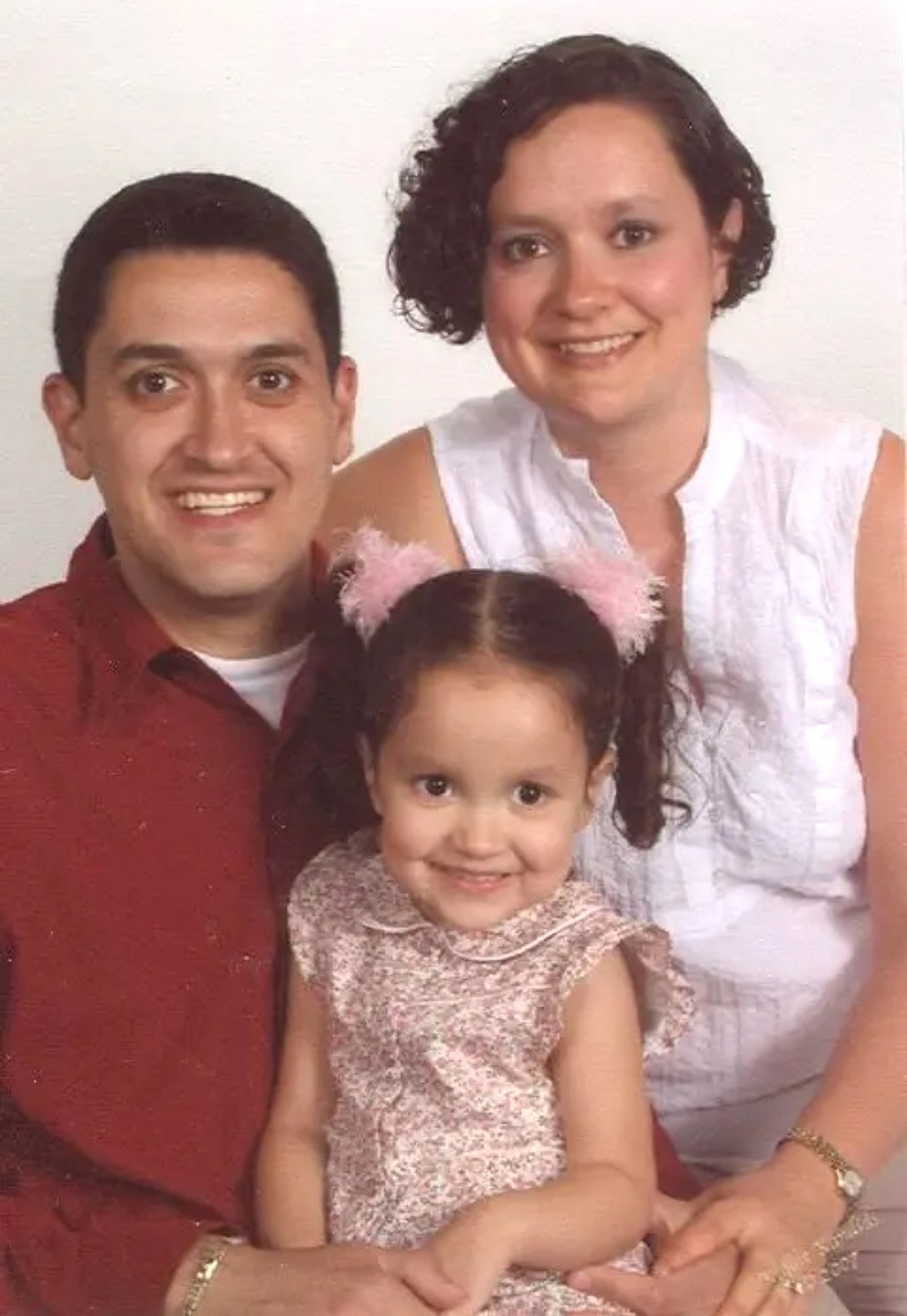

Vinny Fiorino, senior assistant vice president at Amica Insurance, shares the importance of life insurance.

Amica Insurance

She passed away soon after their daughter was born, and Fiorino was left with only a small spousal policy through his then-employer. With his savings depleted from medical costs, he was forced to return to work just three weeks later.

His story underscores a harsh reality: Life can change in an instant, and without a plan in place, families are often left struggling to recover both emotionally and financially.

The bigger picture

Data from the Life Insurance Marketing and Research Association shows the risks of going without life insurance are widespread.

Forty percent of adults say their loved ones would be barely or not at all financially secure if the primary wage earner died unexpectedly. Nearly half say they would have trouble paying bills in less than six months.

Experts stress that life insurance can help prevent that financial freefall, covering essentials like housing, education and day-to-day expenses during a family’s hardest moments.

Vinny Fiorino, senior assistant vice president at Amica Insurance, shares the importance of life insurance.

Amica Insurance

Coverage is more affordable and less complicated than you think. It can cost less than a cup of coffee per week, and it’s not just for breadwinners — anyone with financial responsibilities should consider it.

Amica Insurance helps tailor plans to give families peace of mind.

Tips for families

Drawing from both his personal and professional experience, Fiorino shared some key things viewers should keep in mind:

- Don’t wait: Waiting for the perfect time can cost you more and risk insurability. Even modest coverage is better than none when starting out.

- Start early to save more: Coverage is more affordable and less complicated than you think. It can cost less than a cup of coffee per week, and it’s not just for breadwinners — anyone with financial responsibilities should consider it. Amica Insurance helps tailor plans to give families peace of mind.

- Understand your coverage needs: Evaluate your financial obligations–mortgage, education, income replacement — to determine the right coverage amount.

- Don’t rely solely on employer coverage: Company-provided life insurance may not be sufficient or portable. Consider individual policies for full protection.

- Choose the right type of policy: Term Life: Ideal for temporary needs like income replacement or debt coverage. Whole Life: Offers lifelong coverage and builds cash value.

- Review your policy regularly: Life changes — marriage, children, home purchases — can affect your insurance needs. Reassess coverage periodically.

- Designate and update beneficiaries: Ensure your policy reflects your current wishes. Keep beneficiary designations up to date to avoid legal complications.

- Work with a licensed representative: Amica’s specialists offer personalized guidance to help you choose the right coverage without pressure.

- It’s more affordable than you think: Many people overestimate the cost of coverage.

- Use life insurance for estate planning: Life insurance can help cover estate taxes and ensure your heirs receive their intended inheritance.