An improved freight mix, significant network investments and self-help productivity initiatives are pushing XPO’s financial results higher. The Greenwich, Connecticut-based less-than-truckload carrier again beat analysts’ expectations on Thursday.

XPO (NYSE: XPO) reported adjusted earnings per share of $1.05, which was 6 cents better than the consensus estimate but 7 cents lower year over year. (The adjusted EPS number excluded transaction and restructuring costs.)

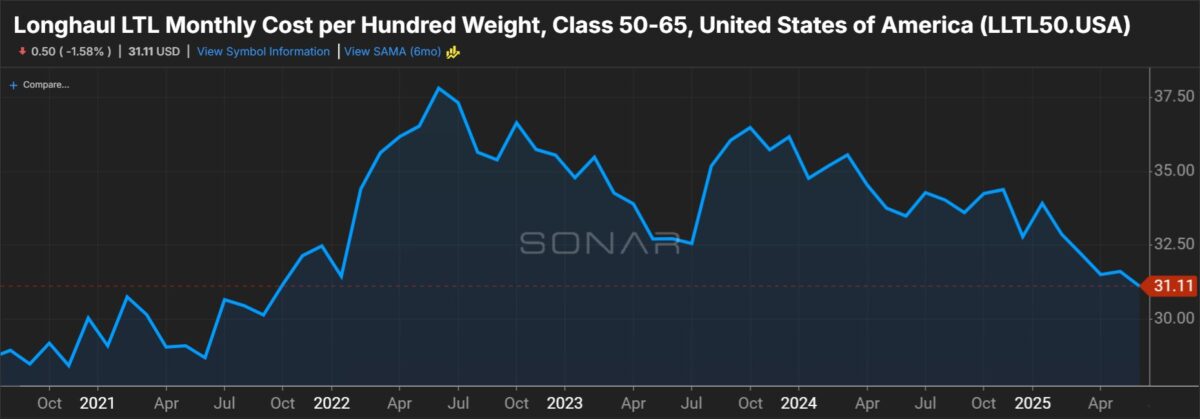

The company’s LTL unit reported a 2.5% y/y decline in revenue to $1.24 billion. A 6.7% decline in tonnage per day was partially offset by a 4.2% increase in revenue per hundredweight, or yield. (Yield was 6.1% higher y/y excluding fuel surcharges.)

A weak manufacturing economy again weighed on LTL industry tonnage in the quarter. XPO’s tonnage decline resulted from of a 5.1% y/y decline in shipments per day and a 1.7% decline in weight per shipment.

On a y/y comparison, XPO’s tonnage fell 5.5% in April, 5.7% in May and 8.9% in June. Preliminary results for July showed an 8% y/y decline. The carrier acknowledged a seasonally weaker June but said July was slightly ahead of normal seasonal patterns.

The two-year-stacked tonnage comps showed an acceleration in the declines (from low-single-digits in the second quarter to 8.8% in July). However, XPO’s prior-year comps get much easier starting in August. From August 2024 through the end of 2024, it averaged mid-single-digit y/y tonnage declines.

(Daily shipments and tonnage increased sequentially in the second quarter by 4.9% and 3.6%, respectively.)

Further, XPO’s freight mix is changing for the better.

The carrier has onboarded over 5,000 local accounts this year. These are largely small-to-midsize businesses that carry better margin profiles. Shipments among this group increased by a high-single-digit percentage in the second quarter, which was a step up from a mid-single-digit increase in the first quarter. The group represents a low-to-mid-20% share of XPO’s LTL revenue currently and the goal is to push that to 30%.

Also, XPO continues to increase premium services revenue, or shipments that incur accessorial charges. This accounts for a low-double-digit percentage of revenue currently and there is opportunity for a few more percentage points of growth.

The LTL unit reported an 82.9% adjusted operating ratio (inverse of operating margin), which was 30 basis points better y/y and 300 bps better than the first quarter. The result was at the top end of management’s guidance.

Purchased transportation expenses (as a percentage of revenue) were down 280 bps y/y. Linehaul miles executed by third-party carriers have been reduced from more than 20% a couple of years ago to 6.8% in the recent quarter.

Also, an AI-enabled model has allowed it to reduce linehaul miles by 3%, empty miles by 10% and freight diversions by more than 80%. It is now running fewer miles (down by a mid-single-digit percentage) to move the same amount of freight.

The initiatives led to a $36 million y/y reduction in the expense line in the quarter. It recently implemented a similar program to rework its pickup and delivery network.

Productivity initiatives are helping to reduce labor hours per shipment, and XPO’s average tractor age is now less than 4 years, which has lowered maintenance costs per mile by 6%.

Most of the carrier’s more than 30 new terminals are now open and it is already carrying the costs to operate them. That means there is significant margin leverage when the market turns.

The LTL unit has delivered nearly 400 bps of margin improvement through the downturn. It outperformed all public carriers by 440 bps in the second quarter. Further, XPO sees “a massive runway ahead” for many of these idiosyncratic initiatives.

The unit normally sees 200 to 250 bps of OR degradation from the second to the third quarter. However, this year it is forecasting no change, implying an 82.9% OR, or 130 bps of y/y improvement. The guide assumes a moderation in the y/y tonnage declines and a continuation of sequential increases in revenue per shipment and yields.

Yield excluding fuel surcharges is expected to increase by at least the same percentage it did in the recent quarter (up 6.1% y/y). XPO’s yields have increased by a mid-teen percentage on a two-year-stacked comparison over the past four quarters.

XPO’s European transportation segment reported a 4% y/y increase in revenue to $841 million with an adjusted earnings before interest, taxes, depreciation and amortization margin of 5.2%, 80 bps lower y/y.

XPO generated $247 million in cash flow from operations in the quarter and reduced its net debt leverage to 2.5 times from 2.7 times a year ago. It had $824 million in liquidity to end the quarter and remains focused on paying down debt and buying back stock.

Those efforts will be bolstered as annual capex steps down from 15% of revenue. The company has already onboarded terminals and refreshed the fleet.

Shares of XPO were down 8.9% at 3:05 p.m. EDT on Thursday compared to the S&P 500, which was flat.

More FreightWaves articles by Todd Maiden: